Why Use Artificial Intelligence?

In recent years, Artificial Intelligence (AI) has become a central topic of discussion, especially regarding its applications, safety, and ethical implications. As a technology rapidly evolving and increasingly relevant, AI’s potential and challenges warrant a deep dive. This blog aims to share CENTRL’s journey with AI, particularly within the context of the CENTRL third party risk and due diligence platform for the financial services industry and explores why we chose to integrate this transformative technology into the CENTRL product suite.

The Inception of Our AI Journey

CENTRL’s AI journey began approximately 18 months ago, sparked by the advent of ChatGPT. Recognizing the transformative potential of Large Language Models (LLMs), CENTRL’s leadership team embarked on a mission to research and understand how we could incorporate AI into our platform. Initially, we had no direct experience with LLMs and limited opinions on their security aspects. However, as we delved deeper, we began to form a clearer picture of what could be achieved and how to implement AI in a manner that would bring significant value to our clients in the form of time savings, unprecedented accuracy and total transparency across the entirety of the due diligence process.

Understanding the CENTRL Platform

Before diving further into our AI integration, it’s essential to provide an overview of our platform. CENTRL is a third-party risk and due diligence platform designed for the financial industry, encompassing modules for bank network management, investment management, and vendor management. Our platform functions as a network, serving both “senders’’ who initiate due diligence by sending questionnaires and “responders” who answer these requests.

The idea for CENTRL originated from our collective fintech background, where repetitive diligence tasks, often conducted in Excel, Word, or PDF formats, consumed countless hours of time. Our goal was to create a more efficient way to handle due diligence questionnaires (DDQs) and Requests for Proposals (RFPs), enabling the reuse of data and eliminating tedious, repetitive tasks. Over time, we have continuously enhanced the AI platform to increase efficiency further, including training our models with industry specific content related across a variety of standardized questionnaires, including ICI, AIMA, ILPA and AFME. Industry specific domain trained models will be key as AI adoption continues to grow, in fact according to a recent Gartner poll more than 50% of the gen AI models that enterprises use will be specific to either an industry or business function by 2027.

Principles Guiding Our AI Integration

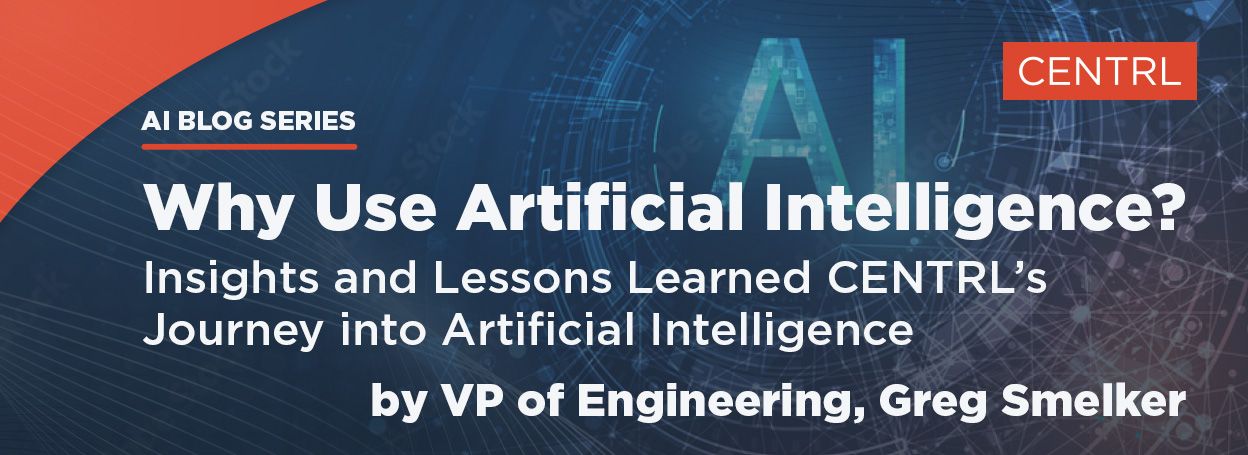

As we researched generative AI, we identified several key principles to guide our interaction with this technology: 1.Prompt Engineering: Leveraging today’s expansive context windows and advancements in retrieval-augmented generation (RAG), we decided to interact exclusively through prompts. Prompt engineering is a critical aspect of working with LLMs, particularly when leveraging today’s expansive context windows and advancements in RAG. By interacting exclusively through prompts, we can ensure data security, enhance flexibility, and optimize the performance of our AI systems. This approach protects our data from being used for training by any other LLM, a significant win for both us and our clients. Additionally, it provides our flexibility, allowing us to switch between LLMs based on cost, throughput, or accuracy, rather than being tied to a single model.

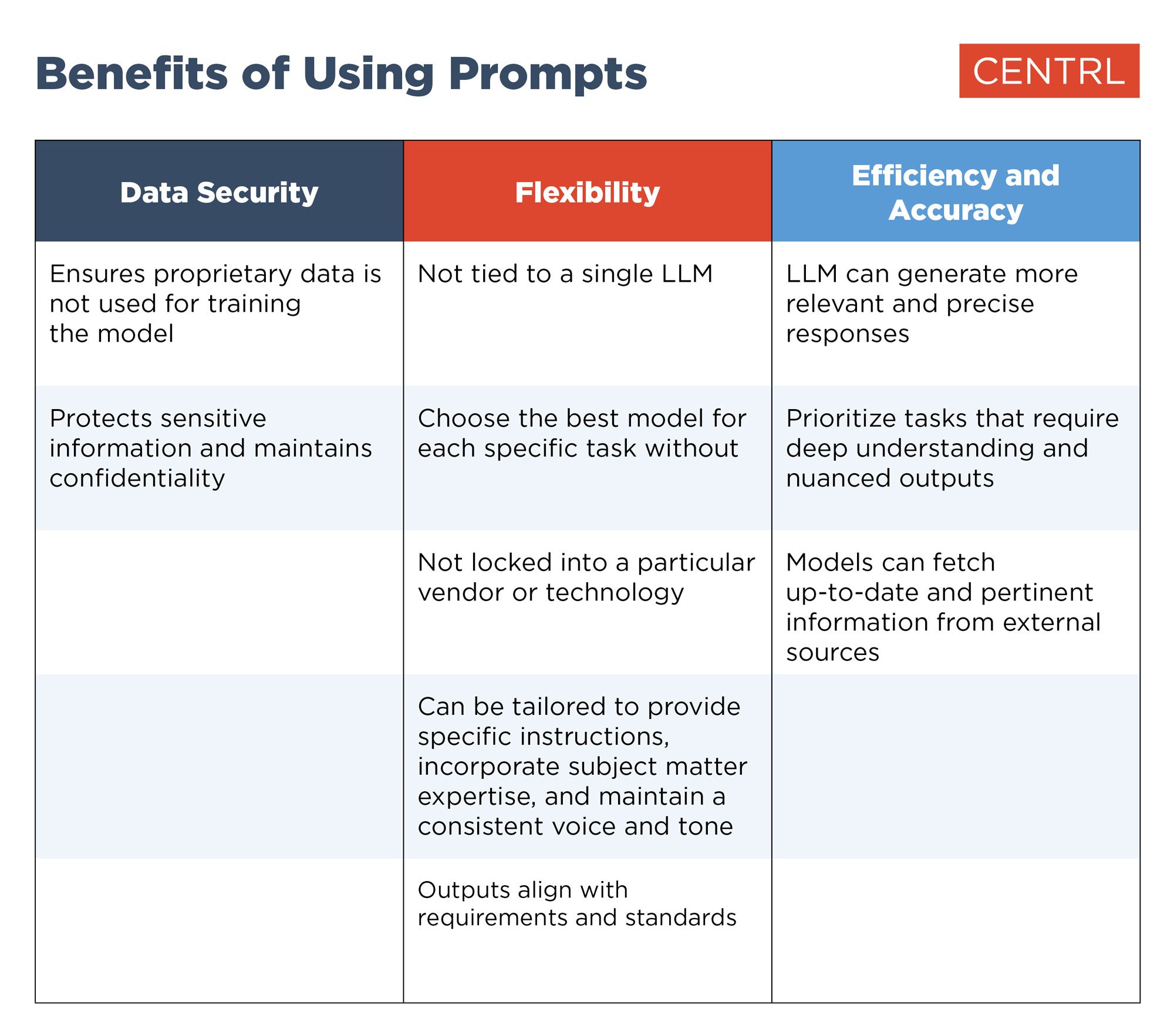

2. Tracking Accuracy: Reliable measures of accuracy are crucial. Testing and gauging accuracy helps ensure the technology performs as expected, building trust in AI’s capabilities. That’s why accurately measuring AI performance is not without its challenges. AI systems, for example, often handle complex tasks that involve nuanced understanding and contextual relevance. Evaluating the accuracy of such tasks will require sophisticated metrics and methodologies as well as human intervention. The data that AI systems work with is often dynamic and evolving. So ensuring your AI remains accurate over time will require continuous monitoring and updates. And consider that, in some cases, the accuracy of AI outputs can be subjective. Different users might have different expectations and interpretations of what constitutes an accurate result. To ensure reliable AI accuracy, several strategies are essential. Benchmarking with standard datasets provides a consistent basis for evaluating and comparing model performance. Continuous testing and validation maintain accuracy over time by regularly assessing the system with new data and scenarios. Incorporating user feedback allows developers to identify shortcomings and iteratively improve the AI’s performance. Together, these strategies ensure the AI adapts, performs well under varying conditions, and meets established benchmarks.

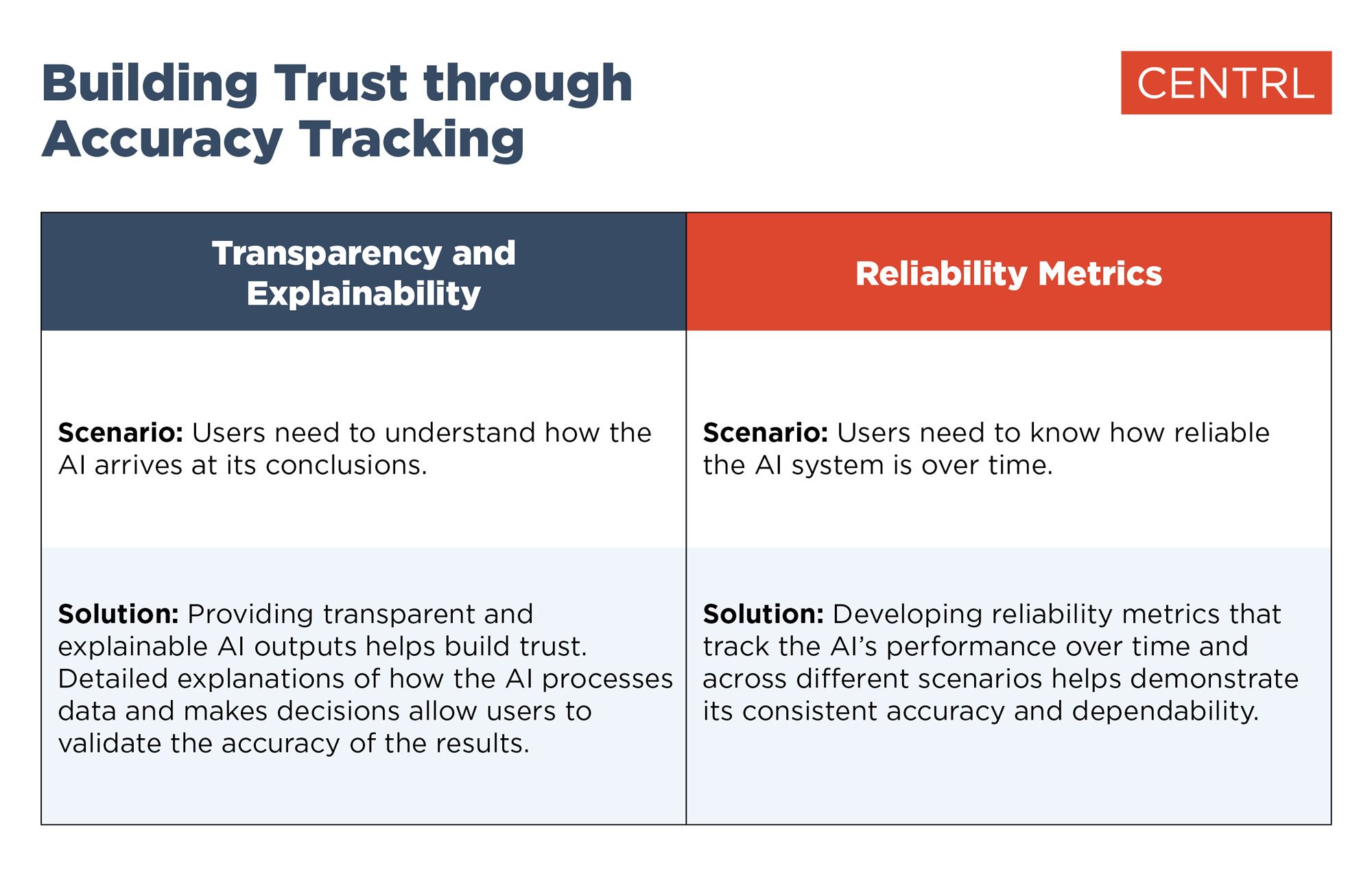

3. Versatile and Flexible Context Windows: Utilizing RAG, we enrich prompts with all necessary data for generation, which significantly enhances the versatility and flexibility of context windows in AI applications. RAG ensures that the AI system has access to a comprehensive set of information, leading to more accurate and reliable outputs. CENTRL provides context to the LLMs, including instructions, subject matter expertise, and specific voice tones, ensuring accurate and reliable performance. This approach not only improves the quality and relevance of AI outputs but enhances its adaptability and integration into various workflows, making it a very powerful tool.

Implementing AI in CENTRL’s Products

With our framework and guiding principles established, the next critical step was identifying the most impactful areas to integrate AI within our application. We deliberated on whether AI should be deployed to send out diligence requests and questionnaires, automate the response process, evaluate the accuracy and completeness of the answers, or generate comprehensive outcome reports. We concluded that AI could be strategically applied across all these functions to enhance efficiency and precision. By implementing AI, we ensure that routine, labor-intensive tasks are handled swiftly and accurately, allowing our clients to focus on higher-level decision-making and strategic oversight. Importantly, while AI manages the extensive data processing and preliminary evaluations, the ultimate control and final decision-making authority remain firmly in the hands of our clients, ensuring both operational efficiency and uncompromised oversight. This balanced approach not only optimizes the diligence process but also maintains the essential human element in critical decision points.

A Practical Use Case: Financial Auditors and Diligence Analysts

Consider the role of a financial auditor or diligence analyst. Their work is often tedious and error-prone due to the sheer volume of data involved. By introducing AI, data becomes manageable, allowing professionals to focus on specific items and disregard the irrelevant. This targeted approach not only enhances accuracy but also allows auditors and analysts to dedicate more time to critical thinking and strategic analysis. This specific use case underscores AI’s immense potential to complement and enhance human efforts, reducing the tedium of data-heavy tasks and improving overall efficiency. We believe this potential extends to numerous other applications, where AI can similarly augment human capabilities and drive better outcomes.

Addressing AI’s Imperfections

Is AI perfect? No, but no technology is. Understanding its strengths and limitations allows us to design appropriately. In many ways, AI is similar to other off-the-shelf technologies: when deployed within a well-constructed framework that includes robust data governance, continuous monitoring, and human oversight, it can function exceptionally well.

The Path Forward

AI still has many questions to answer and ample room for technological growth. However, in well-defined and flexible applications, AI excels in its adaptability and efficiency. It is particularly reliable for enhancing workflows, automating data ingestion, performing summarization, and supporting basic decision-making. According to Forbes, by 2035, AI technologies have the potential to increase productivity 40% or more, particularly in sectors like financial services where data processing and decision-making are critical. For instance, in due diligence, AI can automate routine tasks such as document review and data extraction, significantly reducing the time and effort required from human analysts. AI’s ability to handle large volumes of data with precision is transforming risk management and compliance in the financial sector.

Looking to the future, the integration of AI in financial services is expected to continue expanding. According to a report by McKinsey, the use of AI technologies could generate up to $1 trillion annually in additional value for the global banking industry. This includes improvements in areas such as risk management, operational due diligence, and network management.

Like any tool, AI delivers the best results when used within a structured framework that includes robust data governance, continuous monitoring, and human oversight. By understanding and planning for AI’s limitations while leveraging its strengths, financial institutions can achieve remarkable outcomes. As AI technology continues to evolve, its role in financial services will become even more integral, driving innovation, enhancing efficiency, and ultimately transforming the industry.

Conclusion

Our journey with AI has been enlightening, revealing the immense potential of this technology in transforming the way we serve our clients. By adhering to our guiding principles and leveraging AI’s strengths, we have been able to enhance our platform significantly. As we continue to explore AI’s capabilities, we remain committed to ensuring that our clients benefit from increased efficiency without sacrificing oversight and control.

The future of AI in due diligence and third-party risk management is promising. AI has the potential to revolutionize these areas by providing more sophisticated risk assessments, real-time data analysis, and enhanced decision-making capabilities. According to a study by Gartner, more than 80% of enterprises will have used gen AI APIs or deployed gen AI-enabled applications by 2026. This indicates a significant shift towards AI-driven solutions across industries.

By staying informed about the latest advancements, adapting our strategies accordingly, and maintaining a focus on accuracy and reliability, CENTRL is well-positioned to harness the full potential of AI. We are excited to see how AI will continue to shape and improve our industry, driving innovation and setting new standards for efficiency and precision in due diligence and third-party risk management. Our commitment to leveraging AI responsibly ensures that we can offer our clients cutting-edge solutions while maintaining the highest levels of trust and integrity.

If you’re interested in learning more about CENTRL’s first of its kind AI powered Risk and Due Diligence Platform for the Financial Services industry, visit us here.