Using AI To Transform Manager Due Diligence: CENTRL Introduces New “Verification” Flow

Using AI To Transform Manager Due Diligence: CENTRL Introduces New “Verification” Flow

Manager due diligence is a critical risk management process in the investment industry, serving as the foundation for trust, transparency, and informed decision-making between investors (LPs/Asset Owners) and fund managers (GPs/Asset Managers). Despite its importance, the traditional due diligence questionnaire (DDQ) process is highly inefficient, burdening both issuers and respondents with repetitive tasks, redundant information requests, and lengthy review cycles. While the adoption of digital platforms has introduced some efficiencies, the core workflow remains cumbersome and time-consuming.

Issuers spend hundreds of hours sending out DDQs, many of which request information they already possess or can access through external sources. Meanwhile, respondents must navigate an overwhelming volume of questionnaires, frequently answering duplicate or overlapping questions across multiple requests. The inefficiencies in this process lead to wasted time, increased operational costs, and missed opportunities to focus on high-value risk assessments.

We believe that now is the time to fundamentally rethink this workflow process. The emergence of domain-trained AI modelsprovides a powerful opportunity to revolutionize manager due diligence, making it more efficient, transparent, and insightful. By leveraging AI-driven automation, firms can minimize manual effort, enhance accuracy, and generate more meaningful risk assessments.

The Current End-to-End DDQ Flow

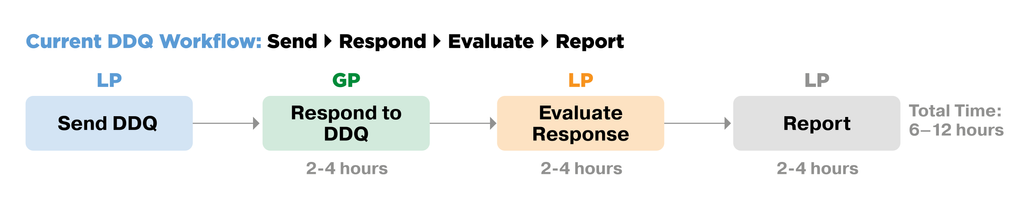

To appreciate the potential for transformation, it is essential to understand the traditional DDQ process. Currently, the process consists of four main steps:

1. Publish – The issuer (LP) sends out DDQs to fund managers, often requesting extensive documentation and responses to standardized or customized questions.

2. Respond – The respondent (GP) completes the DDQ, gathering data from various internal sources, reviewing past submissions, and ensuring consistency across multiple requests.

3. Evaluate – The issuer reviews the responses, cross-referencing them with existing data, analyzing potential risks, and seeking clarification where needed.

4. Report – The final assessment is compiled into a report, summarizing key findings and insights for decision-making.

This end-to-end process typically requires between 6-12 hours per DDQ, depending on the complexity of the questionnaire and the volume of data required. When scaled across hundreds of DDQs, the cumulative workload often becomes overwhelming, leading to bottlenecks and delays. Not surprisingly, due diligence cycles can take 4 to 6 weeks, as multiple stakeholders on both sides engage in back-and-forth exchanges to refine responses and verify information.

Transforming DDQ Process with AI: “Verification” Flow

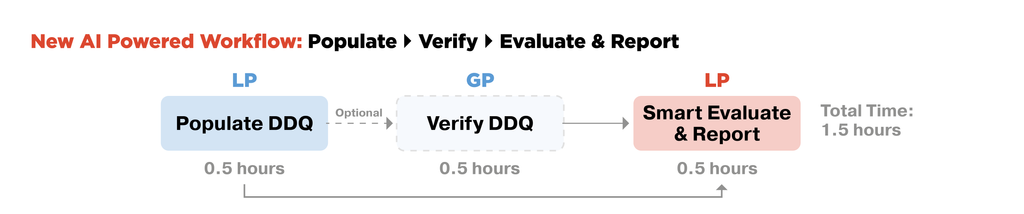

The application of domain-trained AI models offers a transformative approach to the DDQ process. By automating key tasks and leveraging AI-driven insights, CENTRL’s newly introduced “Verification” flow provides an option for due diligence teams to streamline the process, making it faster, more accurate, and less labor-intensive.

Key Features of the AI-Powered Verification Flow

1. AI-Powered Population of the DDQ by the LP

Traditionally, LPs manually create and distribute DDQs, often repopulating similar questionnaires year after year. With AI, this process is significantly enhanced. LPs can now:

Auto-populate DDQs using AI models trained on historical responses, fund prospectuses, and standardized industry questionnaires.

Incorporate external data sources, such as regulatory filings (e.g., ADV reports), reducing the need for redundant data collection.

Ensure accuracy and transparency by linking AI-generated responses to source documents, allowing LPs to easily verify information and trace back references.

What previously took hours or days can now be completed in minutes, drastically reducing the manual workload for LPs and improving the accuracy of pre-filled responses. In some cases, the process can be abbreviated even further and you can go directly to the Evaluation and Reporting step if the information from documents and other sources is largely complete.

2. Publish for Verification

Once the AI-assisted DDQ is generated, LPs can choose to publish the full questionnaire or only the unanswered sections to GPs for completion or verification. This targeted approach minimizes the effort required from GPs by:

Reducing redundant responses, as fund managers only need to verify or supplement AI-populated answers instead of starting from scratch.

Enhancing collaboration, as the process becomes more streamlined and focused on necessary updates rather than wholesale data collection.

By eliminating unnecessary back-and-forth communication, this step significantly accelerates response times and improves the overall efficiency of the due diligence process.

3. AI-Powered Evaluation & Reporting

The final step in the AI-powered workflow involves real-time evaluation and automated report generation. The AI system:

Analyzes DDQ responses against predefined risk criteria, flagging potential concerns and inconsistencies.

Generates risk assessment reports instantly, using customizable formats that align with LPs’ internal evaluation frameworks.

Enhances decision-making with AI-driven insights, allowing analysts to focus on strategic assessments rather than manual data review.

What once took weeks of back-and-forth communication and manual analysis can now be accomplished in minutes, ensuring more timely and accurate due diligence outcomes.

The Broader Impact of AI in Due Diligence

The introduction of AI-powered workflows in manager due diligence has far-reaching implications for the investment industry. By reducing the administrative burden on both LPs and GPs, AI enables professionals to allocate more time to high-value tasks, such as:

Identifying emerging risks by analyzing trends and anomalies across multiple DDQs.

Enhancing investment decision-making with real-time risk intelligence and automated benchmarking.

Improving compliance and regulatory adherence by maintaining clear audit trails and ensuring documentation accuracy.

Furthermore, AI-driven automation fosters greater consistency in due diligence practices, reducing human errors and enhancing transparency. As the industry continues to embrace AI technologies, we anticipate significant improvements in the speed, accuracy, and effectiveness of risk assessments.

Looking Ahead: The Future of AI in Due Diligence

We anticipate the future of AI to be characterized by an increasing reliance on AI “agents” to act as highly intelligent, automated assistants capable of managing a vast array of tasks that traditionally required human oversight. These AI-driven agents will function as dynamic problem solvers, capable of interpreting complex data sets, automating routine checks, and providing valuable insights into the potential risks in due diligence. Their impact will extend across multiple aspects of the diligence process, enabling firms to work more proactively.

The potential is endless.