Breaking Through the Institutional Barrier: How GPs Approaching $1B AUM Can Meet LP Expectations Without Diligence Debt

Breaking Through the Institutional Barrier: How GPs Approaching $1B AUM Can Meet LP Expectations Without Diligence Debt

As GPs scale toward the $1B AUM mark, they inevitably enter a new arena of capital raising—one that involves a more structured, resource-intensive, and higher-stakes set of expectations from institutional LPs. This transition can be transformative, but only if GPs prepare for the operational and diligence rigor that accompanies institutional interest.

In this blog, we explore three key areas:

1. Due Diligence Expectations by Investor Type

2. Growing AUM Without Diligence Debt

3. How the Tech Stack Can Help GPs Scale Institutional Relationships

1. Due Diligence Expectations by Investor Type

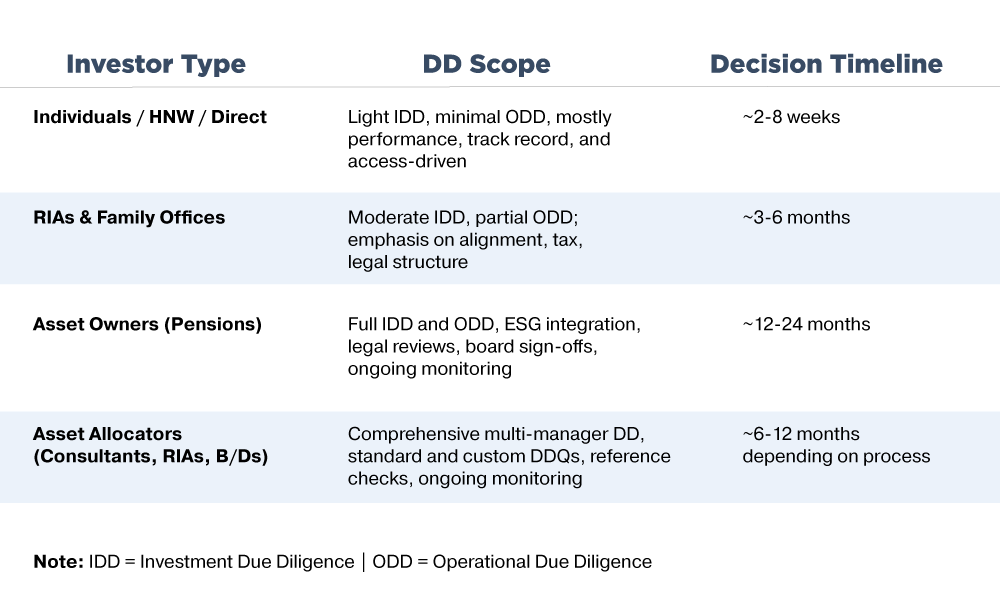

The definition and depth of due diligence (DD) vary widely depending on the investor type, their internal approval processes, and their fiduciary obligations. What may suffice for a HNW investor won’t fly with a pension fund.

Here’s a simplified breakdown of how DD expectations vary across the LP spectrum. Of course, these vary and may look different by investor type and their geographic location, but this should help set the stage:

Key Takeaway:

As you scale, so do the expectations. Asset owners and allocators will not only want your pitch deck—they’ll ask for updates to assist with the investment reporting and annual compliance attestations for external managers.

2. Growing AUM Without Diligence Debt

Every institutional LP will require a diligence review, and many will supplement that with their own custom questionnaires, document requests, and references. Preparing on the front end can be the difference between a smooth close and a stalled pipeline.

Diligence Debt occurs when the volumes and complexity of RFPs, RFIs, and DDQs takes up more time and effort than your staff can manage. It’s like a weed that grows and is nearly impossible to stomp out, until you hit a breaking point and need help.

Here’s how to avoid accumulating diligence debt:

Centralize and Organize Core Materials: Ensure legal documents (PPMs, LPAs), compliance manuals, track records, audited financials, and fund strategy memos are updated and easily accessible.

Maintain a Master DDQ: This serves as the single source of truth that can be used directly or mapped to investor-specific questionnaires.

Expect Customization: Roughly 70% of institutional investors will have their own unique DDQ formats, often split between ODD and IDD. Plan for this by building a modular knowledge base.

Be Ready for Investment and Operational Due Diligence: Time the preparation of these materials around capital raising cycles. Waiting for an LP to request these documents is too late.

3. How Technology Can Help

As GPs approach $1B AUM, there’s often a parallel journey: operational maturation. Building a scalable infrastructure becomes essential not just for internal efficiency but to meet the expectations of institutional LPs.

At a minimum, GPs should deploy:

CRM: To manage and track investor interactions, follow-ups, and pipeline status.

Investor Portals: Some GPs are upgrading their investor experience with personalized, on-demand access to fund documents, reports, and updates, which helps foster trust and reduce one-off email requests.

Database for Prospecting

To go further, consider:

RFP & DDQ Automation Tools: Platforms like Response360 allow you to store and reuse previously approved responses to custom DDQs and RFPs. This becomes invaluable when facing 15+ questionnaires across LPs with different formats and follow-up cadences.

Imagine your biggest potential investor sends you a huge RFP to complete – 15 pages in a Word file. You’re done with it in about 30 minutes – without having to do anything other than using Centrl Smart Response, which pulls responses from your DDQ and recently completed questionnaires. That’s efficiency!

Benefits of Tech Adoption:

Helps speed up LP onboarding during fundraising

Accelerates response time to LP inquiries

Ensures consistency and compliance in DD responses

Creates a repeatable process for future funds

Frees up IR and BD teams to focus on relationships, not office work

Final Thoughts

GPs approaching $1B AUM are at an inflection point. Institutional investors can unlock large checks and long-term partnerships—but only for those firms that demonstrate operational readiness and a disciplined approach to due diligence. By proactively organizing your materials, understanding LP-specific timelines, and using technology to scale, you position your firm not just for your next raise—but for sustainable, scalable growth.

Remember: Institutional capital isn’t just about raising more—it’s about operating better and meeting the nuanced diligence requirements of your investors.