Investment Due Diligence & Research

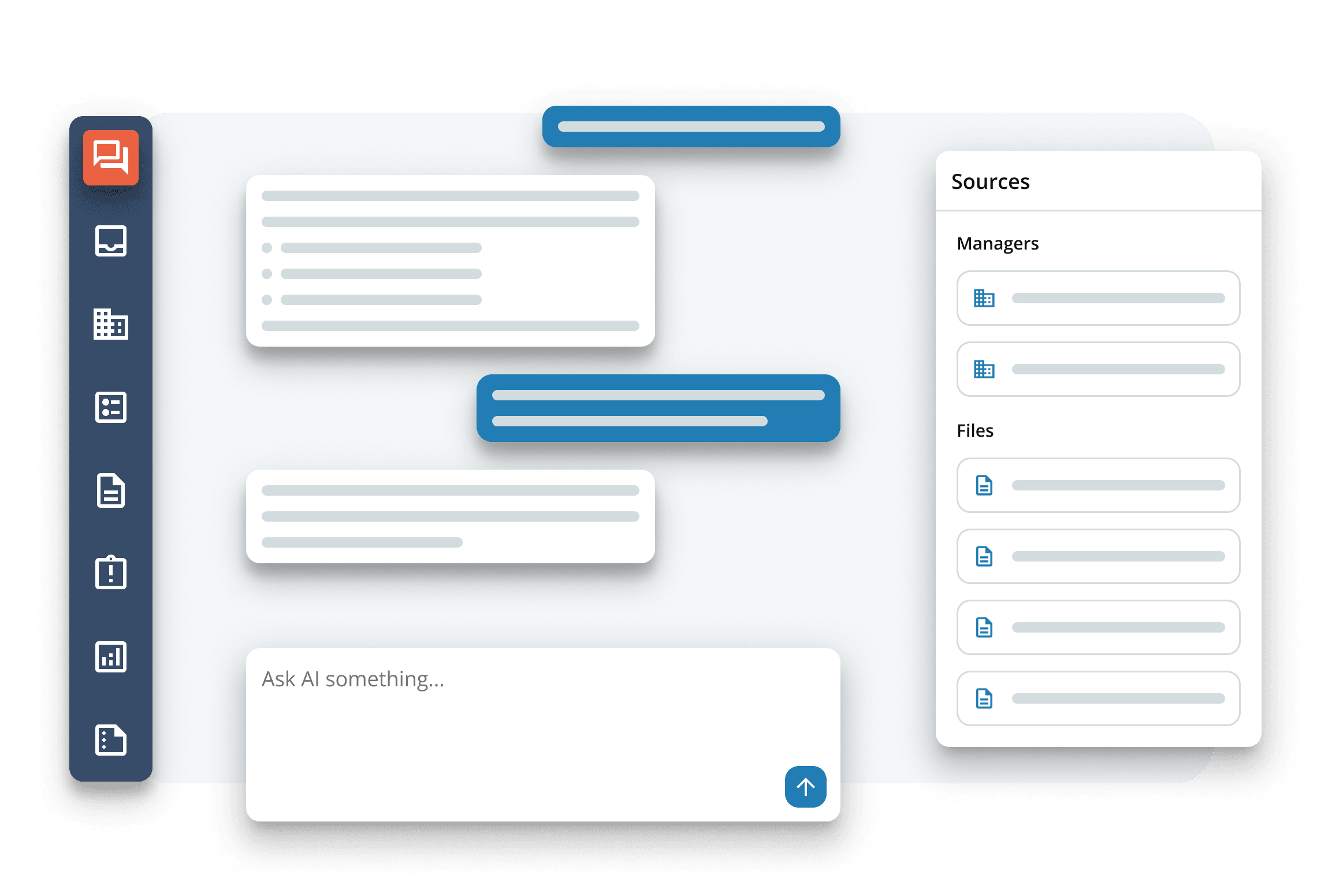

Make smarter investment decisions with a fully digital approach. CENTRL empowers teams to efficiently conduct IDD and manager research, with seamless integration into your current workflows. Collect, manage, and store documents via your proprietary answer and file libraries.

Leverage CENTRL’s AI capabilities to reduce human errors and monitor portfolios through every stage of the due diligence process. Apply custom rules and scoring, work collaboratively across your team, and unlock valuable intelligence and insights with real-time analytics.

Solutions

Operation Due Diligence

Strengthen your operational due diligence with a more connected, automated workflow. CENTRL integrates seamlessly with your current workflows and data systems to collect and manage documents via your proprietary answer and file libraries, send questionnaires, and track manager activity.

Leverage CENTRL’s AI capabilities to reduce human errors and monitor portfolios through every stage of the due diligence process. Apply custom rules and scoring, work collaboratively across your team, and unlock valuable intelligence and insights with real-time analytics.

Solutions

Subadvisor Oversight

Enhance sub-advisory oversight and ensure your sub-advisors consistently meet expectations across multiple streams, including investment, operational, and compliance requirements. Stay current with the latest profiles and streamline data collection and analysis to maintain comprehensive visibility. Automatically flag anomalies, detect material changes in responses and filings, and apply risk-based scoring to generate a clear advisor risk dashboard for fund boards and senior leadership.

Leverage CENTRL’s AI capabilities to reduce human errors and monitor portfolios through every stage of the due diligence process. Apply custom rules and scoring, work collaboratively across your team, and unlock valuable intelligence and insights with real-time analytics.

Solutions

Vendor Risk Management

Vendor risk management is a critical process for evaluating both new and existing suppliers to assess their reliability, financial health, regulatory compliance, and overall risk to your organization. CENTRL AI platform streamlines the process of identifying and monitoring potential issues so you can proactively mitigate risk. Draw intelligence and insights to make informed onboarding decisions to best manage vendor relationships with confidence.

Solutions